liazaharova.ru

News

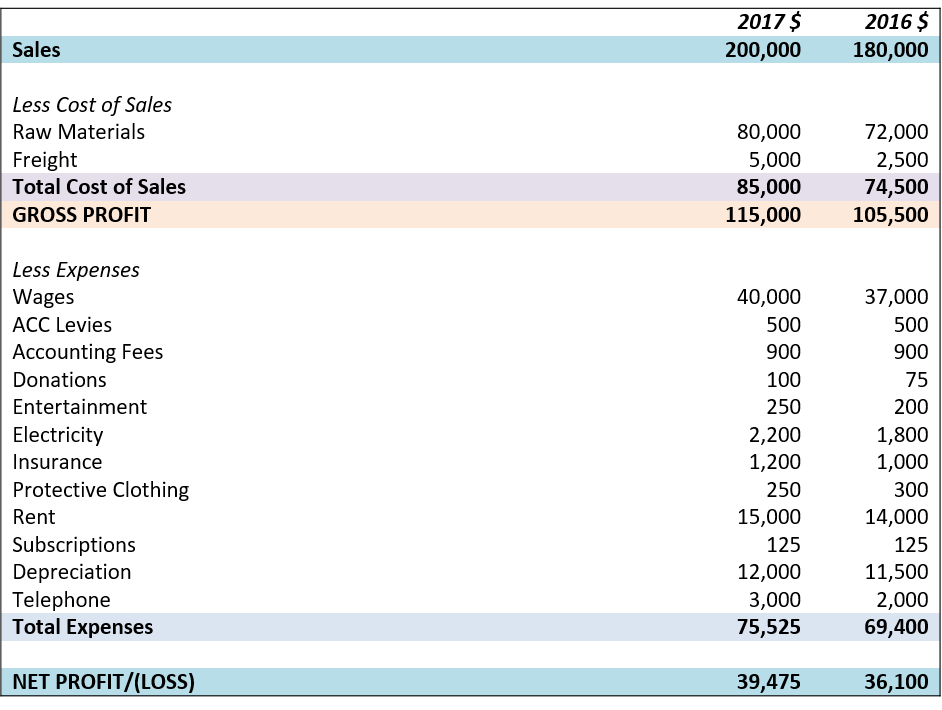

What Are Profit And Loss Statements

It looks at different cash sources, like operations, investing, and financing, and reports the changes in those accounts. A profit & loss statement shows the. A profit and loss statement is calculated by totaling all of a business's revenue sources and subtracting from that all the business's expenses that are. A P&L statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. A profit and loss statement (commonly called a P&L) is a financial document that measures your expenses and sales during a certain time period. A Profit & Loss Statement (P&L) measures the activity of a business over a period of time – usually a month, a quarter, or a year. The Profit and Loss, or Income Statement, is a financial statement typically presented alongside a Balance Sheet and Statement of Cash Flow. Usually produced. A P&L statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given. A profit and loss statement, also known as a P&L statement, measures a company's sales and expenses during a specified period of time. A profit and loss statement is a financial report that shows how much your business has spent and earned over a specified time. It also shows whether you've. It looks at different cash sources, like operations, investing, and financing, and reports the changes in those accounts. A profit & loss statement shows the. A profit and loss statement is calculated by totaling all of a business's revenue sources and subtracting from that all the business's expenses that are. A P&L statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll. A profit and loss statement (commonly called a P&L) is a financial document that measures your expenses and sales during a certain time period. A Profit & Loss Statement (P&L) measures the activity of a business over a period of time – usually a month, a quarter, or a year. The Profit and Loss, or Income Statement, is a financial statement typically presented alongside a Balance Sheet and Statement of Cash Flow. Usually produced. A P&L statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given. A profit and loss statement, also known as a P&L statement, measures a company's sales and expenses during a specified period of time. A profit and loss statement is a financial report that shows how much your business has spent and earned over a specified time. It also shows whether you've.

This guide will help you better understand your financial position by analyzing your profit and loss (P&L) statement. Profit and loss is one of the three most important parts of the financial statement, the other two being the balance sheet and the cash flow statement. You can use this statement to track revenues and expenses so that you can determine the operating performance of your business over a period of time. The three basic financial statements are the income statement (or profit and loss statement), the balance sheet, and the cash flow statement. The P&L statement provides a breakdown of revenue generated and expenses incurred. This allows you to see how profitable your business is and how much money is. Profit and loss statements organize a company's total income compared to its costs, split up into different line items. The profit and loss (P&L) statement outlines a company's revenues, costs and expenses over a specified period. The profit and loss (P&L) statement outlines a company's revenues, costs and expenses over a specified period. The P&L Statement shows revenues, expenses, gains, and losses over a specific period of time such as a month, quarter, or year. A profit and loss statement (commonly called a P&L) is a financial document that measures your expenses and sales during a certain time period. A profit and loss statement is a financial statement that summarizes your company's revenue, costs and expenses incurred during a specified period. Use our free profit and loss statement template to review your business performance, and check out the Wise business account as a smart way to cut your bank. What is a profit and loss statement (P&L)?. A profit and loss statement (P&L), also called an income statement or statement of operations, is a financial report. The P&L Statement shows revenues, expenses, gains, and losses over a specific period of time such as a month, quarter, or year. The profit and loss statement is a financial document that provides a snapshot of a business's revenues, costs, and expenses over a specific period of time. What is a P&L Statement? A P&L statement is a document that compares the total income of a business against its debt and expenses. A P&L statement is an. The profit and loss statement, also known as income statement, displays the net profit or loss of a business over a specified period of time. A profit and loss statement, or P and L statement, is a financial report that summarizes revenue, expenditures, and expenses over a fiscal quarter or year. How to Write a Profit and Loss Statement · Step 1 – Track Your Revenue · Step 2 – Determine the Cost of Sales · Step 3 – Figure Out Your Gross Profit · Step 4 –. The value displayed after subtracting the cost of goods sold from the revenue is your company's gross profit. The expenses section shows how much money you.

1 2 3 4 5